Tobacco tax reform is on the home stretch. On Monday there was an expert hearing in the Finance Committee of the Bundestag, in June the legislative project should be completed. For the first time in six years, the tobacco tax is to be tightened again.

[If you want the latest news from Berlin, Germany and the world live on your cell phone, we recommend our app, which you can download here for Apple and Android devices.]

As early as February of this year, Federal Finance Minister Olaf Scholz made it clear, among other things, that he would like to include cigarettes in which nicotine-containing liquids are vaporized in the tobacco tax. The CDU, CSU and SPD had agreed on a number of points in a coalition round. Financial politicians in the Union had given up their resistance, it was said in February.

The planned package is intended to generate additional tax revenue of 11.290 billion euros by the end of 2025. The classic tobacco tax is to bring in an additional 6.6 billion euros, almost three billion the new tax on e-cigarettes and almost two billion euros the additional tax on less harmful products. In 2020, the revenue from the tobacco tax totaled 14.6 billion euros. The cornerstones of the controversial reform are now largely set.

Moderate tax increase on cigarettes

According to the proposal by the Federal Ministry of Finance, all tobacco products and similar products should be taxed higher. A gradual increase is planned for the period from 2022 to 2026. Each pack of tobacco cigarettes will cost around 8 cents more per year, which means the tax plus will be around 2.5 percent.

The moderate increase is overdue, the tax screw was last turned in 2015. Reform critics such as Monika Schaller from the German Cancer Research Center (DKFZ) consider the planned tax increase to be far too weak - at least ten percent are necessary to persuade smokers to quit or not to let them start at all.

Around every fourth adult in Germany still regularly smokes cigarettes, despite the high risk of cancer. How much more smokers will soon pay is still unclear. The tobacco companies will probably pass the tax increase on to consumers. Brand-name cigarettes currently cost around seven euros per pack – in order to avoid small change, it could become more expensive in 10-cent increments from 2022.

Large tax jump for e-cigarettes and tobacco heaters

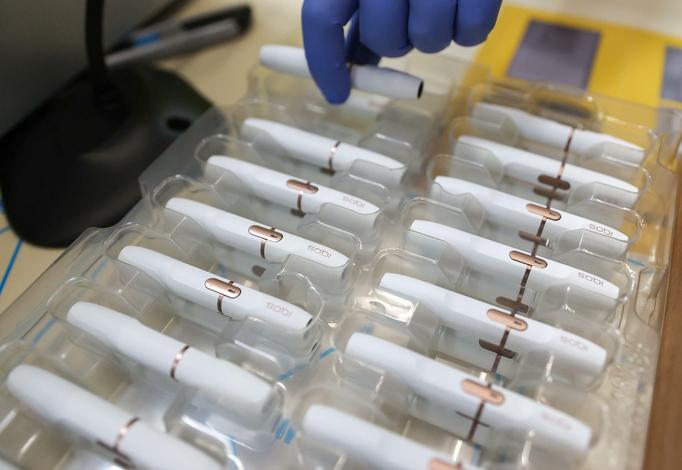

Significantly more taxes are to be incurred for e-cigarettes and "heat-not-burn" products, in which tobacco is no longer burned but heated. A special tax is levied on tobacco heaters, which are fiscally only classified as pipe tobacco, in order to tax them at the same level as tobacco cigarettes. According to calculations by the tobacco company Philip Morris, the tax burden on this increases by almost four times.

A separate tax rate for nicotine-containing substances will be introduced for e-cigarettes, which previously only included VAT. According to calculations by the "Alliance for Tobacco-Free Enjoyment", in which e-cigarette companies have joined forces, the price for a cigarette equivalent would increase from 22 to 57 cents by 2025. However, a high dose of nicotine was used for this calculation. If the shot contains less nicotine, the tax increase and thus the price increase will be weaker.

Alarm bells at the manufacturers

The fact that the economic hopefuls and still niche products, tobacco heaters, are to be heavily taxed makes alarm bells ring. Because the industry is changing: Industry giants are changing course and want to build up an additional mainstay, Philip Morris, for example, relies on the "Iqos" tobacco heater and British American Tobacco on "glo".

According to Philip Morris, the globally active group has already invested 8.1 billion dollars in the development of tobacco heaters. Legislation should not retrospectively "penalize" companies for such investments - "Heat not burn" products emit 90 to 95 percent less harmful or potentially harmful substances than cigarettes.

It is true that significantly fewer pollutants are released when using a tobacco heater, as some authorities in various countries have confirmed. However, there are still no long-term studies to be able to clearly assess the health risk. The bill "favours products of combustion," says Philip Morris.

[More on the topic: The strictest lockdown in the world - The cigarette ban in South Africa and the consequences (T+)].

This is remarkable: The cigarette company complains that a planned tax increase would be in favor of cigarettes compared to other products - and criticizes it.

Equally high taxes despite fewer pollutants?

The key question is whether products with a lower pollutant content should be taxed the same or almost the same. No, according to the industry - that would drive many consumers into the black market or prevent smokers from switching to the new products. But do many smokers switch?

The scientist Tobias Effertz, who works for the "Non-Smoking Action Alliance", complains that most vaporizer users also reach for the cigarette butt. Such a "dual use" is significantly more harmful to health than the exclusive consumption of an addictive substance, said Effertz.

The industry representatives, on the other hand, get backing from medical professionals. Tobias Rüther from the tobacco outpatient clinic at Munich University Hospital sees e-cigarettes and sometimes also tobacco heaters as a “real alternative” for smokers because they contain fewer harmful substances. It therefore makes sense to tax such products less than tobacco cigarettes.

[More on the topic: Seduction through the back door – How tobacco companies circumvent the advertising ban on the Internet (T+)].

The second sticking point is the question of whether higher taxes - especially the big plus for tobacco heaters and e-cigarettes - will boost the black market: Because the illegal business is financially more worthwhile, the supply could increase. Such warnings come not only from the industry, but also from the police union.

Jan Mücke from the industry association BVTE refers to the consequences of the sharp tax increases in the years 2003 to 2005 - since then the proportion of smuggled cigarettes has remained high: "We would now see the same evasive movements with tobacco heaters and e-cigarettes." Tobias Effertz from the "Non-Smoking Action Alliance" disagrees : "The tobacco industry is clearly exaggerating here."

Statements from the Bundestag

The two rapporteurs of the government coalition, Sebastian Brehm (CSU) and Michael Schrodi (SPD), indicated that they could imagine a more significant increase in tobacco tax on conventional cigarettes. Brehm and Schrodi are also in favor of taxing the water pipe tobacco used in shishas higher than previously planned.

more on the subject

Drastic price increases possibleThe federal government also wants to levy a tobacco tax on e-cigarettes

Markus GrabitzCriticism comes from the opposition. With regard to e-cigarettes, Till Mansmann from the FDP finds it “incomprehensible from a health policy perspective why the least harmful product should experience by far the greatest tax jump”. Green Stefan Schmidt warns that the planned tax jump for e-cigarettes and tobacco heaters will prevent smokers from “at least switching to less harmful products such as e-cigarettes if they don’t manage to quit completely”. (Tsp with dpa)

Test winner at Stiftung Warentest:...

How to get the perfect look for Cos...

Dry elbows: This is how brittle ski...

Cream for Rosacea: The Best Creams