The cash Insider reports in the insider briefing prior to the market on the latest observations on what is happening on the Swiss market and is also active on Twitter under @cashInsider. Take a look at the tracker certificate on the Swiss stock favorites from cash Insider.

+++

Football has been king for weeks now, and the "round leather" has dominated the news situation - although the reporting in recent days has unfortunately not been about what's happening on the pitch at all. Once again it shows that when the teams from Germany and Hungary face each other in the Allianz Arena in Munich like yesterday, it's not just about who wins after 90 minutes, it's also about a lot of money. And it's about politics.

The same could be said of stock market activity. So it makes sense that the analysts at Kepler Cheuvreux led by Torsten Sauter recently put their adjustments to the Swiss stock favorites under the motto football.

As a reminder, analysts pulled the shares of Barry Callebaut, Julius Baer, Sulzer and Zehnder from the bench. On the pitch they joined those from Galenica, Swiss Life and SFS Group. The shares of Nestlé, DKSH and SoftwareOne, on the other hand, went off the field.

It is no less interesting that Sauter and his colleagues in the department have put together an eleven-share team and are revealing a lot about the "players on the substitutes' bench".

Givaudan is in goal, followed by SIG Combibloc, Nestlé, Galenica and Sulzer in defence. Logitech, Swiss Life and Lem can be found in the middle. The top attackers are Tecan, Sika and Richemont - what a "trident".

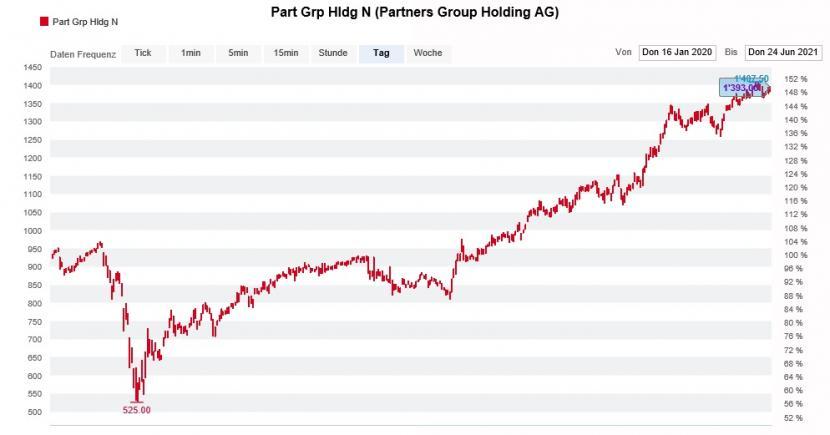

A star striker before the Lord: price development of Sika shares over the last five years (source: www.cash.ch)

According to their own statements, the analysts could in future fall back on the shares of Barry Callebaut, Emmi, UBS or Zurich Insurance as an alternative to the goalkeeper. These companies have one thing in common: they all have defensive qualities.

In defence, on the other hand, paper from SIG Combibloc, Nestlé, Lastminute.com, Temenos, Burckhardt Compression or Holcim could be used. In the midfield they see possible alternatives in Valora, Komax, Metall Zug, Clariant, Swatch Group and Feintool. And for the striker, Arbonia, Swissquote, Zehnder, VAT Group or Oerlikon come into question.

When the analysts at Kepler Cheuvreux make the next adjustments to their favorite Swiss stocks in just under three months, they will only have fond memories of the European Football Championship. Let's see what motto they will use for the adjustments...

+++

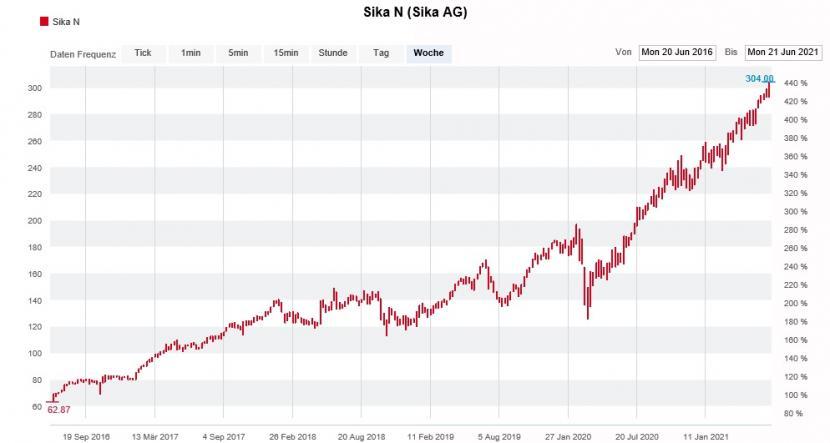

When Berenberg Bank issued a sell recommendation for the Partners Group shares in January last year and set a price target of CHF 607, I thought to myself: How brave is that?

In view of the pressure on yields, large institutional investors stormed the risk capital specialist from Baar's door even then - which was reflected in price quotations of 900 francs and more.

When the papers cost less than 600 francs a few weeks later, I was quite impressed. However, I have to admit that the analyst Panos Ellinas would probably have fought a losing battle had it not been for the stock market turbulence caused by the pandemic.

But instead of reconsidering his sell recommendation after reaching his price target, he went one step further in the middle of the valley of tears and reduced the price target to 445 francs - only to raise it to 545 and then to 671 francs over the course of the year.

Now - a year later and almost 800 francs higher - Ellinas meekly throws in the towel. He upgrades the shares from "Sell" to "Hold". The business model has proven to be a lot more resilient than he thought during the Covid 19 pandemic. In addition, customer demand has remained unbroken to this day, the analyst ruefully admits.

Price performance of Partners Group shares since the initial sell recommendation (source: www.cash.ch)

The fact that a calculated downside potential of more than 10 percent can still be derived from his recent price target of CHF 1,240 may almost sound like mockery.

When I reported in mid-February this year that the suffering of pessimistic stock analysts was becoming unbearable, I wrote:

But the analyst at Berenberg Bank will also have to put up with uncomfortable questions. While many of his colleagues at other banks recommend buying Partners Group shares, he counters with "Sell" and a price target of just 671 francs. In addition to the high rating, the analyst originally argued with the economic consequences of the Covid 19 pandemic. The latter is proving to be less and less tenable.

In recent weeks, analysts have repeatedly capitulated in their sell recommendations. The sales recommendation by J.P. Morgan for Clariant shares no longer exists. That with every new course record more could follow is almost as certain as amen in church. Like the short seller, bearish analysts are increasingly an endangered species. Whether they should therefore be included on the list of species worthy of protection is open to debate.

| The cash Insider takes market rumors as well as strategy, industry or company studies and interprets them. Market rumors are deliberately not checked for their truthfulness. Rumours, speculation and everything that interests dealers and market participants should be passed on to the readers quickly. No responsibility is taken for the correctness of the content. The personal opinion of the cash insider does not have to coincide with that of the cash editorial team. The cash Insider is active on the stock exchange itself. This is the only way he can achieve the market proximity necessary for this type of news. The opinions expressed do not constitute buy or sell recommendations to the readership. |

Test winner at Stiftung Warentest:...

How to get the perfect look for Cos...

Dry elbows: This is how brittle ski...

Cream for Rosacea: The Best Creams