The corona pandemic has given pharmaceutical stocks too much attention. Probably never before have news portals, daily newspapers and even tabloids dedicated themselves so extensively to the development, mode of action and approval of vaccines and drugs. This also attracted private investors (again) to this industry.

The sharp price gains of the successful corona vaccine developers Astrazeneca, Biontech and Moderna provided a further boost. They proved that pharmaceutical stocks can generate enormous price gains in a short period of time. But this should not hide the high risks for shareholders. Individual pharmaceutical stocks, especially from newcomer companies, require staying power and strong nerves.

Curevac is a good example of the Corona Pharma euphoria. The Tübingen-based company's share price had tripled from almost 40 euros to over 120 euros by the end of 2021 in view of the hopes for an mRNA Covid vaccine. But other developers were faster, so that the share price initially crumbled. Finally, when the effectiveness of the Curevac vaccine turned out to be less than intended, the price suddenly fell back to around 50 euros.

Biontech vaccine success a flash in the pan?

It is also not possible to say whether and when the rising star Biontech will be able to repeat its success. The company very quickly managed to develop a market-ready Covid mRNA vaccine. It was also Biontech's first commercial active ingredient after years of research. But no investor knows how long it will be before Biontech can also make profits with mRNA drugs for the individual treatment of cancer.

Pharmaceutical industry overall:

High hopes are also attached to Arrowhead Pharmaceutical, which is traded on the US NASDAQ stock exchange. This is shown by well-known investors such as the Vanguard Group. Blackrock and Johnson & Johnson. The Arrowhead team is researching drugs that can be used to specifically deactivate genes in order to also fight cancer.

Research and development costs millions

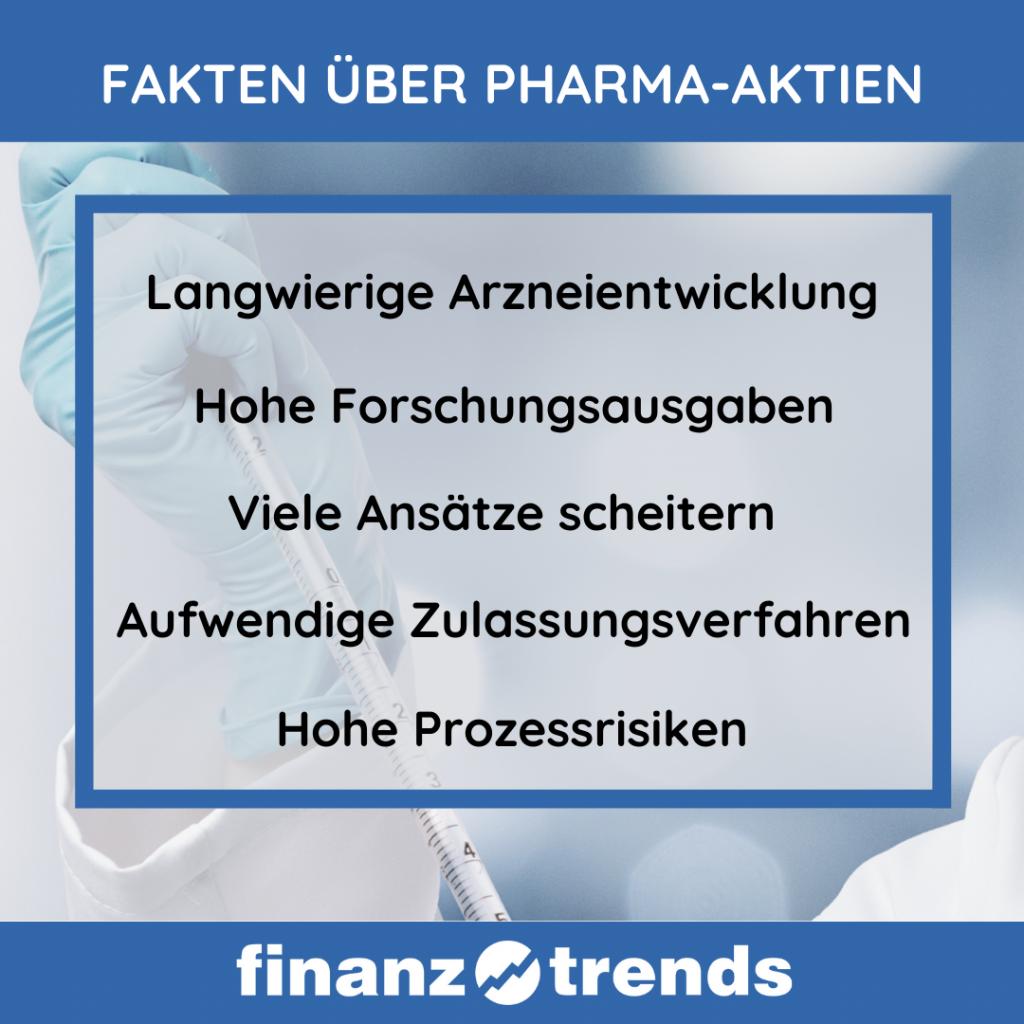

Top or flop, this often only becomes apparent in pharmaceutical research and the development of new active ingredients, drugs, devices and therapies after the companies have invested a lot of money and time. According to studies, 40 percent of new drug approaches still fail, even in late development phases. In this respect, it is like gambling to catch a price rocket with an investment in a single pharmaceutical stock. This is especially true when the stock exchange company only has a few approaches in the pipeline.

Are pharmaceutical stocks only for speculative investors? No, that would be the wrong conclusion. Viewed as an industry, the investment risk looks quite different. The overall sector is suitable for more defensive, long-term oriented investors who prefer continuous income and predictable growth with low price fluctuations.

Should Investors Sell Immediately? Or is it worth getting started with Exela?

Healthcare stocks are resilient

There are several reasons for this. The pharmaceutical industry is a stable, crisis-proof source of revenue, since people hardly save on their health even in difficult times. It is also a business without fluctuations overall.

And several factors ensure future growth in the pharmaceutical business and medical segment. In developing and emerging countries, the standard of living is increasing with improved health systems and higher medical expenses. In addition, life expectancy is increasing worldwide, so that people are also patients longer on average.

Older age means growth

More and older people also require more intensive medical care. Previously unknown or rare age-related diseases are gradually becoming a mass phenomenon and generate new demand. And finally, research continues to advance and new active ingredients and therapies are constantly being developed.

This all sounds like a safe investment space. But there are risks that at least slow down euphoria and expected returns. As mentioned, this includes the comparatively small proportion of successfully marketable drugs.

Billion blockbusters are rare

So-called blockbuster preparations are only rarely developed. This is the name of a drug bestseller that generates billions of US dollars worldwide. In addition, their patent protection is limited in time. This means that pharmaceutical companies have to invest an above-average amount of money in research and development compared to other sectors.

Even if the development succeeds in making it market-ready, lasting business success is not guaranteed. The state approval of drugs is complex and has to be carried out in several markets. And even after introduction, side effects of drugs sometimes only become apparent later, despite clinical studies. This can require improvements or mean the end of a preparation. There is also the threat of claims for damages if damage to health can be traced back to a drug.

Competitors can spoil success

The risks can break through at any time with individual shares and severely depress the share price. Anyone who wants to focus on individual titles and, for example, new mRNA cancer therapies, should see this as a speculative investment. Investors should regularly follow company publications, in particular on the state of research, marketing forecasts and target achievement. And as the example of the corona vaccines has shown, it is important to keep an eye on the competition. Because the company that is the first to offer an approved preparation has the best marketing opportunities. It is not uncommon for the following to apply: The winner takes it all.

Anyone who shys away from such thrills as a private investor does not have to turn away from the pharmaceutical industry. After all, if you invest in many titles at the same time with a fund, you don't have to fear individual failures, legal disputes and profit warnings. Rather, fund investors can benefit from overall growth.

Get a free PDF report on Ballard Power: Download here for free

ETF bundles many pharmaceutical stocks

Overall, broad pharmaceutical investments are considered a defensive, comparatively crisis-proof investment. The Stiftung Warentest also comes to this conclusion in its special. There are hardly any cyclical, cyclical fluctuations like those of car manufacturers, electronics manufacturers, airlines and hotel chains. In addition, heavyweights dominate the pharmaceutical sector and have often been generating stable profits for decades and reliably distributing dividends to investors.

Inexpensive equity ETFs that are traded on German stock exchanges are ideal for investing broadly and internationally in the pharmaceutical industry. The replication of established indices is a common method to generate a fund portfolio almost automatically without expensive analysis effort.

Health funds most popular

Many well-known fund providers such as Amundi, Invesco, iShares, Lyxor, State Street and Xtracker offer themed funds. According to the specialist portal extraETF, the investment sums invested by investors in such theme ETFs show that the health sector is particularly popular with investors. In terms of the investment volume in the billions, health care ranks ahead of technology and industrial automation.

The ETF providers rely on established, well-known indices to bring the pharmaceutical sector into the securities portfolio:

Before a detailed look at the indices, investors should be aware that the pharmaceutical market is dominated by a few global pharmaceutical giants. In this respect, the heavyweights are represented in several indices, so that an investment in several of these indices is not recommended. The depot would only become more confusing, but the range of investments would at best be homeopathically broadened.

USA and Switzerland overrepresented

The most important pharmaceutical companies are concentrated in a few countries, above all they are based in the USA and Switzerland. In the MSCI World Health Care Index, eight out of ten companies are from these two countries. Pharmaceutical companies based in Japan, England, Denmark, France and Germany follow at some distance.

Country shares MSCI World Health Care Index

| United States | 71% |

| Switzerland | 8% |

| Japan | 6% |

| United Kingdom | 4% |

| Denmark | 3% |

| France< /td> | 2% |

| Germany | 2% |

The top 5 big names in MSCI's Global Pharma Index are Johnson & Johnson (US, Dow Jones Index member), United Health Group (US), Roche (Switzerland), Pfizer (US) and Abbott Labratories (US). Only the first two are weighted at over five percent in the overall portfolio.

If the country focus is narrowed, the regional accumulation has an unfavorable effect on investors who want to minimize their risk. Due to the small number of pharmaceutical companies, individual drug manufacturers are given significantly more weight in the STOXX Europe 600 Health Care.

Europe means a high Swiss share

While the Swiss Roche AG is represented in the MSCI World Health Care Index with less than four percent, the Roche share in the STOXX Europe 600 Health Care Index is more than 15 percent. At Novartis, less than three percent compared to a good 13 percent. Investors should be aware of that.

It is just as extreme in the country distribution of the fund capital. Based on the MSCI World Health Care Index, the ETF invest more than 70 percent of the investor's capital in the USA. About eight percent goes into shares in Swiss companies, and about two percent each into shares in French and German pharmaceutical companies.

In the STOXX Europe 600 Health Care Index, Switzerland ranks at the top with more than 37 percent. French companies account for a whopping 12 percent of ETF capital. Around ten percent of investor capital flows into shares in German drug manufacturers

Country shares STOXX Europe 600 Health Care Index

| Switzerland | 37% |

| United Kingdom | 18% |

| Denmark | 14% |

| France | 12% |

| Germany | 10% |

Buying a global and at the same time a European pharmaceutical index ETF is not really a portfolio enrichment. Then a look at the Nasdaq Biotechnology Index is recommended. Companies that are not represented in the other pharmaceutical funds are represented in the corresponding index funds.

NASDAQ unites biotech newcomers

Investors who, for example, want to invest in the much-discussed Covid vaccine manufacturers and mRNA technology in general are well served by the Nasdaq index. Biontech and Moderna are represented, but also Astrazeneca and Arrowhead Pharmaceutical. And even though 90 percent of the Nasdaq biotech index is made up of US companies, it also includes Chinese biotechnology companies in the portfolio. After all, the country is in second place in the country distribution of the index, ahead of England and Germany.

In this respect, investors could consider adding an ETF based on the Nasdaq Biotechnology Index to an international pharmaceutical ETF. It brings more values and countries, but also more opportunities and risks. Since younger, smaller companies are included, investors must expect more price fluctuations. But they have the opportunity to benefit from the success and growth of this "young pharmaceutical generation" with a higher return on custody.

Should Exela investors sell immediately? Or is it worth getting started?

How will Exela fare now? Is your money safe in this stock? The answers to these questions and why you need to act now can be found in the current analysis of the Exela share.

Exela: Buy or Sell? Read more here...

Test winner at Stiftung Warentest:...

How to get the perfect look for Cos...

Dry elbows: This is how brittle ski...

Cream for Rosacea: The Best Creams